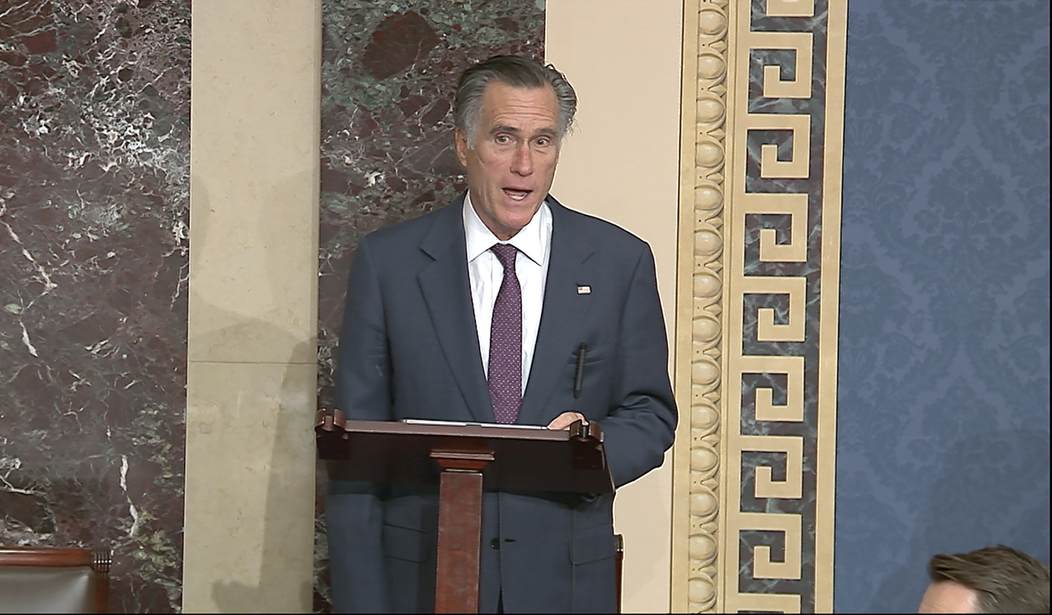

Former 2012 presidential candidate, US Senator, and overall pain in the a**, Mitt Romney has had an epiphany: the rich should pay higher taxes. Romney, who one could argue has become a soft Democrat, decided to have his own ‘Liz Cheney’ moment by voicing support for higher taxes on the rich. Yes, Mitt ‘Tax me more, Daddy’ Romney has arrived (via NYT):

Typically, Democrats insist on higher taxes, and Republicans insist on lower spending. But given the magnitude of our national debt as well as the proximity of the cliff, both are necessary. DOGE took a slash-and-burn approach to budget cutting and failed spectacularly. Europe demonstrates that exorbitant taxation without spending restraint crushes economic vitality and thus speeds how fast the cliff arrives.

On the spending-cut front, only entitlement reform would make a meaningful difference, since programs such as Social Security and Medicare account for a majority of government outlays. No one countenances cutting benefits for current or near retirees. But Social Security and Medicare benefits for future retirees should be means-tested — need-based, that is to say — and the starting age for entitlement payments should be linked to American life expectancy.

And on the tax front, it’s time for rich people like me to pay more.

Our roughly 17 percent average tariff rate helps the revenue math. Doubling it — which seemed possible shortly after “Liberation Day” — would further burden lower- and middle-income families and would have severe market consequences.

Yeah, I’ve read enough, though it’s a bit entertaining. The Wall Street Journal’s editorial board opted to respond. Wealth inequality isn’t a real issue. That rests with reforming entitlements and the trillions in unfunded liabilities. Yes, Trump vowed never to touch these programs, which I disagree with, but it’s going to take both parties to fix Social Security and Medicare. We know for sure that one group, Democrats, isn’t going to lift a finger. Social Security was never meant to last this long, as advancements in pharmaceuticals have made living with chronic diseases a possibility, whereas death was the only ending. It’s led to increased life expectancy. It's also one of the reasons why health care has become exceedingly expensive:

Recommended

The first point to make is that if Mr. Romney wants to pay more taxes, by all means go ahead. Write a check to the Treasury. It’s a writ of attainder to target an individual with legislation, Democrats, but maybe Mitt won’t mind.

The rich who favor higher taxes pitch this as an act of civic virtue. But paying higher taxes on income or capital gains is no great sacrifice for them because they’re already rich. Mr. Romney made his fortune at Bain Capital, and good for him. He can afford to pay more now, but would the 28-year-old Mitt still on the make have thought so? Raising taxes makes it harder for others to get rich.

Mr. Romney is especially eager to raise the annual income cap on Social Security payroll taxes. That cap is $184,500 in 2026 and rises each year with inflation. Democrats want to raise the cap much higher or eliminate it. Mr. Romney thinks this should be the trade for entitlement reforms.

Not likely. Democrats eliminated the income cap for Medicare payroll taxes of 1.45% (2.9% including employer) in 1993, but have you noticed a Democratic desire to reform Medicare? They ran against Mr. Romney in 2012 by saying his modest reform amounted to throwing grandma off a cliff.

The Medicare tax increase has merely become another marginal-rate tax hike on work. The Social Security payroll tax is 6.2% each for employee and employer, so lifting the income cap on that tax on the working middle class would be even more onerous.

[…]

The U.S. has a federal debt problem, and entitlement reform is essential. It will happen because sooner or later lenders will demand it. Until then, we’ll consider tax increases when we see a Democratic presidential nominee propose a serious plan to reform Social Security and Medicare. Do not bet your retirement money on it happening.

But please, Mitt, cut that check to the IRS.

Editor’s Note: Do you enjoy Townhall's conservative reporting that takes on the radical left and woke media? Please support our work so that we can continue to bring you the truth.

Join TOWNHALL VIP and use the promo code MERRY74 for 74% off your VIP membership!

Merry Christmas!

Join the conversation as a VIP Member